Meals with or without tax benefits?

The main rule according to the Swedish Tax Agency is that free meals that are not entertainment should always be taxed as benefits.

If you do not pay for the meal yourself - so-called free meal - then you should make a meal deduction from your allowance, since you have not had increased meal costs. The allowance is reduced. If you have paid for the meal yourself, then you should not make any meal deduction from your allowance.

Meals without tax benefit

Applies to meals that you have been offered and that are tax-free benefit:

-

hotel breakfast which is mandatorily included in the room price (i.e. you cannot opt out of it from the price).

-

meal that is included in the ticket price (i.e. you cannot opt out of the price)

-

internal/external representation, internal staff conferences or internal training (maximum 7 days).

For meals on public transport (e.g. train or plane) that are mandatorily included in the ticket price, there is no reduction in the allowance.

Meals with tax benefit

Applies to meals that you have not paid for yourself, and which are taxable benefit, for example:

-

When you are at a conference/external training where lunch and dinner are included in the conference price. In this case, KTH has paid for the meals.

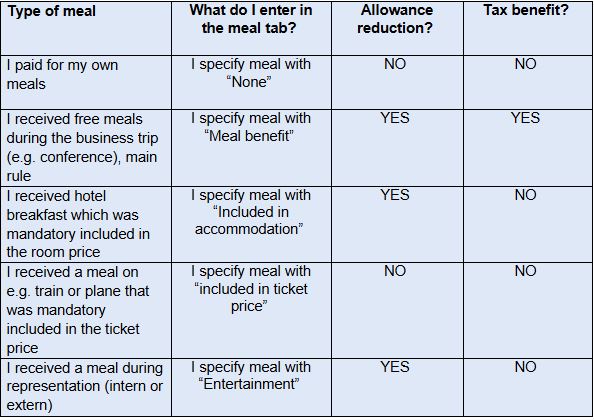

The table below shows whether reduction and tax benefit should occur for different types of costs:

Clarification: if you add breakfast for a fee when you book a room, it will be a breakfast with tax benefit. The same applies if you add a meal for a fee, e.g. when you pay a course or conference fee or when you book a train ticket.

Free meals with tax benefits that are not linked to business trips, so-called Working Meals

Examples of working meals:

-

meal at project meeting, seminar

-

inviting a colleague to a meal

-

meal at board meeting

-

meal at course completion

-

meal with guest lecturer

-

meal during meeting that is shorter than 6 hours (excluding time for the meal).