Register allowance for business trips with holiday/days off in KTH-Expense

According to the Swedish Tax Agency's rules, you are not entitled to allowance (per diem) if you have holiday/days off before, during or after a business trip.

Travel in Sweden

Holiday/days off before the business trip

-

You register the day/time when the conference started, so you do not enter the day/time you left home or KTH.

Holiday/days off under the business trip

-

You register the day/time you left home or KTH and the day/time you returned to your home or KTH but reduce your allowance by an amount corresponding to the days off.

-

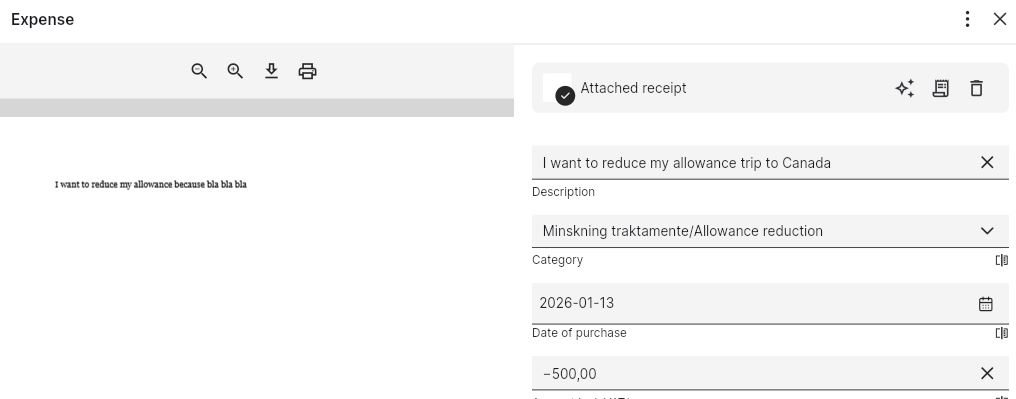

Reduction is made by registering an expense. Select the expense category "Allowance reduction" where you register the amount with a minus sign. Instead of scanning a receipt, you scan an explanation of why the allowance should be reduced.

Holiday/days off after the business trip

-

You register the day/time when the conference ended, so you do not enter the day/time when you returned home or to KTH.

Travel abroad

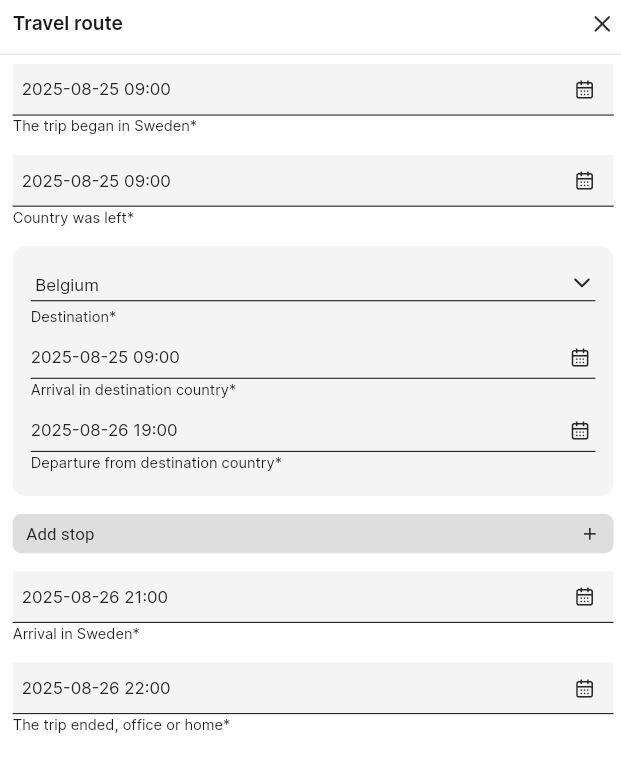

Example of holiday before the business trip

The conference started on Wednesday at 9 AM, your colleagues flew on Tuesday evening but you already flew on Friday night at 6 PM the week before. You must register so that you receive allowance from Wednesday at 9 AM, see example below:

Holiday/days off under the business trip

-

You register allowance for the entire period but reduce your allowance by an amount corresponding to the days off.

-

Reduction is made by registering an expense. Select the expense catogory “Allowance reduction” where you register the amount with a minus sign. Instead of scanning a receipt, you scan an explanation of why the allowance should be reduced.

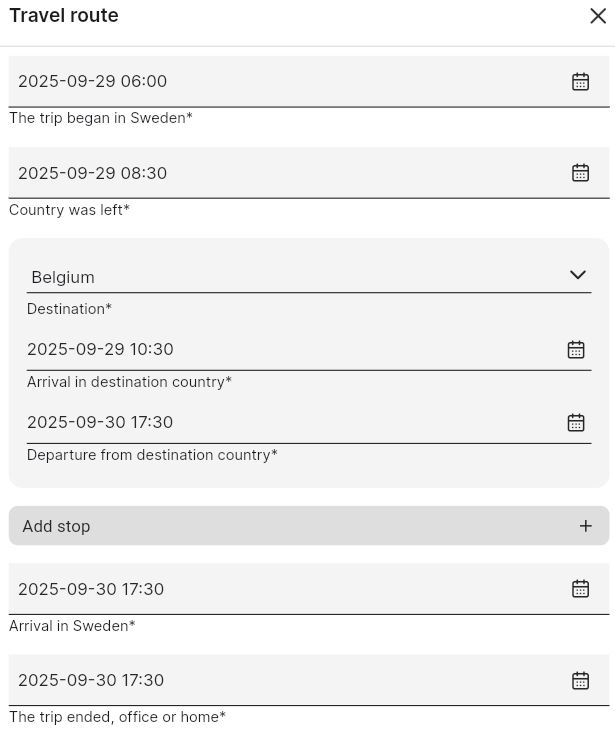

Example of holiday after the business trip

The conference ended at 5.30 PM on Friday, your colleagues flew home the same evening, but you chose to have a few days off and came home on Tuesday evening at 10 PM. You must register so that you receive allowance until Friday at 5.30 PM, see example below:

For more information regarding allowances: Important information about expense reports and reimbursements

You can find the allowance amounts here: Domestic and foreign allowance amounts