Register VAT for EU project in KTH-Expense

For EU projects, foreign VAT may not be included in EU project accounting. Therefore, the foreign VAT must be reported separately with a special expense type ”VAT EU project” when you register your expense.

When you register your expense, do the following:

-

Scan the receipt using the app or register a new expense and attach a scanned receipt

-

The system interprets the receipt

-

Check that all required fields are filled in

-

Select project

-

Tap ”Split receipt” at the bottom of the page

-

Enter a description

-

Select the expense category “VAT EU project”

-

Enter the foreign VAT in the field “Amount incl. VAT” – Note: do not enter anything in the field “VAT”

-

Select cost center and project

-

Select approver

-

Save

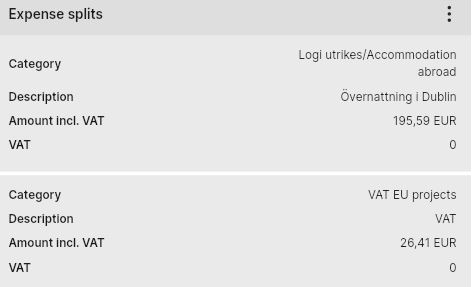

Your expense now consists of two expense categories:

-

The first, e.g. Hotel abroad, with the amount excluding the foreign VAT

-

The second, VAT EU project, with the foreign VAT amount.

Here is an example of what a split receipt looks like: